Monetary assertion analysis includes a thorough evaluation of a business’s earnings assertion, stability sheets and cash circulate statement. Assist and resistance ranges are among the most widely utilized technical tools in the Forex market. Once you’ve been trading for a while, you may need come across foreign exchange tick charts. These indicators monitor the flow of cash out and in of the market, which may help determine tops and bottoms.

Filippo Ucchino created InvestinGoal, an Introducing Dealer company offering digital consulting and customized digital assistance providers for merchants and investors. The similarities between basic analysis and technical evaluation are listed under. The greatest trading platforms for basic and technical analysis are listed below. Foreign Exchange dealer platforms present analysis reviews, academic material, webinars, and market analysis stories that combine technical and basic analysis insights.

Key Differences Between Basic And Technical Evaluation

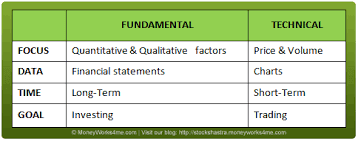

Proper utility of elementary analysis assists traders in deciding on promising foreign money pairs to trade, figuring out overvalued or undervalued property, and identifying market developments. Key features of fundamental analysis embrace its comprehensive market analysis, long-term strategy, and worth identification. The difference between fundamental analysis and technical evaluation generally lies of their aims, knowledge sources, and time horizons. Fundamental evaluation focuses on business value and long-term views, whereas technical evaluation studies market tendencies and value patterns. The selection between the 2 usually is dependent upon funding fashion, threat tolerance, and monetary fundamental vs technical analysis targets. Many people favor to make use of each approaches together, particularly when partaking in research-based decisions via a stock market buying and selling app or other investment platforms.

Basic Vs Technical Analysis: A 2025 Comparative Study

Elementary analysis is a useful tool for long-term investments but is less adaptable to short-term moves. It provides a balanced method by considering qualitative and quantitative components, though decoding them could be Non-fungible token subjective. Alternatively, technical analysis supplies a quick, visual way to evaluate belongings, nevertheless it too has limits. Traders and traders usually use technical analysis with other methods for a extra complete technique.

Technical evaluation doesn’t rely on the basics of the corporate but somewhat on the tendencies of the stock and the psychology of the market. Fundamental analysis involves the examination of a company’s fundamentals to establish its true price. Under are the key differences between basic and technical analysis in phrases of inventory market worth analysis. Technical evaluation can be helpful to some traders and analysts, however it requires a balanced perspective that comes with fundamentals and an understanding of the bigger image. Basic analysis seeks to ascertain a stock’s intrinsic worth by studying its financial statements and operations of the underlying company.

- Catching the turning factors of value swings ables traders to realize excessive returns over short intervals of time.

- It gives Forex merchants a larger scope on the components causing the movements of specific currencies.

- These are used to establish tendencies and reversals, as well as to arrange help and resistance levels.

- And, our intuitive market sentiment indicator gives you insights into market circumstances on any given day.

- A technical indicator is a mathematical calculation that’s applied to a market’s past knowledge regarding worth, volume or other calculations derived from value or volume.

- Technical evaluation is applied to a lot of stocks in a short amount of time utilizing the instruments and patterns.

In summary, while elementary analysis dives into the ‘what’ and ‘why’ of a company’s value, technical evaluation focuses on the ‘when’ and ‘how’ of buying and selling it. In short, fundamental evaluation is an method that is undertaken by traders and works on the principle of “ purchase and hold”. Buyers who go by elementary evaluation, base their selections to buy a inventory on a complete understanding of an organization and hold their investments for a longer https://www.xcritical.com/ period. Candlestick charts provide a superior visible illustration and enhanced sample recognition, making them ideal for active traders. While bar charts present related data, they lack the intuitive visible alerts offered by candlesticks. Line charts, though helpful for recognizing developments, don’t present detailed value motion.

A Practical Take A Glance At Strengths And Weaknesses

Monetary analysis focuses on evaluating a company’s financial statements, while elementary evaluation also considers financial situations, business developments, and qualitative elements. Fundamental evaluation evaluates a company’s intrinsic value by assessing associated monetary, economic, and qualitative factors. It examines financial statements, market developments, economic situations, and trade indicators to evaluate a company’s overall well being and progress potential.

With superior AI suggestions, Respect offers a personalised investment that helps you make informed decisions tailor-made to your goals and profile. Trading Quantity analysis is essential for confirming the power of a value movement. High volume during a price enhance indicates strong shopping for curiosity, whereas high quantity throughout a worth lower suggests strong promoting stress. These statements present insights into the company’s profitability, monetary place, and cash-generation capabilities. Understanding each methodologies is crucial for buyers, as they provide completely different views on stock valuation and market behaviour.

Fundamental analysis enables traders to grasp the present fiscal situation and future potential returns before investing. It assists investors in figuring out undervalued belongings with progress potential and avoiding overpriced assets which will endure value reductions. For a complete analysis of shares, investors profit from incorporating both elementary and technical approaches quite than relying exclusively on one method. Each approach provides a different perspective that leads to a extra sturdy evaluation.